How to Save for a Down Payment

“Do not save what is left after spending, but spend what is left after saving.”

- Warren Buffet

A lot of future first-time home buyers struggle to find a simple strategy to save for a down-payment. Whether it be for a car, home or any other large purchase, creating a plan to achieve your financial goals is important. The key to saving for a downpayment is as follows: Open a savings account, use a savings calculator & contribute monthly, and lastly (and most importantly), track spending & budget.

Opening a savings account is an important step in saving for any medium to large purchase, even if it’s just for a vacation. It’s helpful to have the funds in a separate account from your main checking account so you can stay organized and keep a clear view of your progress. In addition, savings accounts typically offer a higher interest rate which is essentially a small form of payment for you keeping your money with a bank. It’s also important is to open a high-yield savings account - a savings account with a higher than typical interest rate, some savings accounts pay next to nothing in interest (for example 0.01% interest).

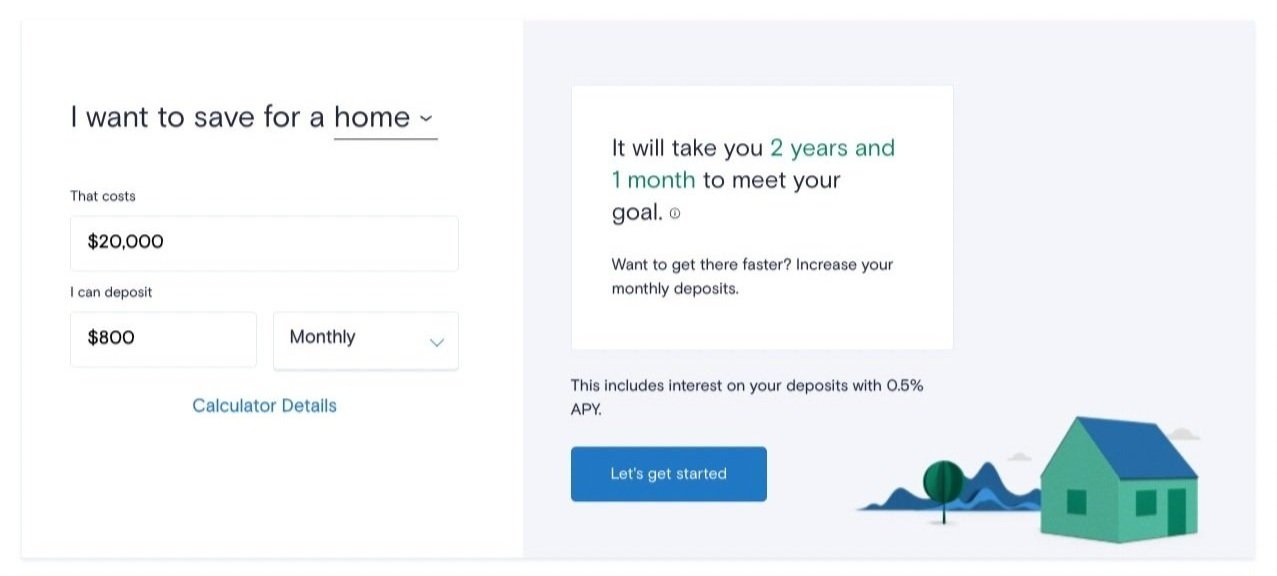

A savings calculator is a great way to see how much you should contribute to your savings either weekly, bi-weekly (every other week) or monthly to hit a specific goal for a down-payment. After you decide how much you can contribute, it will calculate how long it will take you to hit your goal. Keep in mind it’s much easier to control your spending versus controlling how much you take in; try to cut out any unnecessary expenses.

“A budget is telling your money where to go instead of wondering where it went.”

Tracking and budgeting spending is important to anyone who wants control over their finances. There are plenty of great apps and websites out there to assist with this. For keeping on top of credit score, I recommend Mint, and for tracking and budgeting I recommend Marcus by Goldman Sachs. Not only is Marcus a high-yield savings account, it also offers an over-the-top view of all your finances in one place. If you are interested in signing-up here is a referral link.

Lastly, another option to consider if you are younger or do not plan on buying a home for quite some time is to contribute to a Roth-IRA and after 5 years, you can withdraw up to $10,000 un-taxed and un-penalized for a first time home purchase. This is a great strategy to consider if you are 18, 19, or even in your early 20’s. See more here.

For more information on how to manage finances, here’s a great video from Real estate agent and Youtube content creator Graham Stephan: